A five year fixed mortgage at <1%. What this means and what you can do about it…

How low can they go?

In case you’re not fixated with the financial press like me – in which case you’re probably normal – you may have missed this headline grabbing rate from Nationwide released last week: 0.99% fixed for five years.

Let me repeat that again for added impact… A mortgage for 0.99% fixed for five years.

Excuse the basic maths, but on a £500,000 loan this is equivalent to just £416.67 interest paid per month. Ask anyone who was paying a mortgage back in the early 1990s about their repayments and they will probably fall off their chair when they read that.

This is important for a number of reasons.

1) This should act as a continued catalyst for house prices

We’ve heard this story before. Remember 2007? In that case, it was mortgage companies getting creative with their mortgage terms. Products like NINJA loans (No Income No Job or Assets) became the catalyst for the Financial Crises of 2008, as the US housing losses were shared amongst the financial system and for a while nobody could locate where the bad debt was.

This time around, mortgage terms are more stringent. However, the general rates of interest payable are much lower, meaning it remains as easy to get a mortgage today as it was then for most people. Easy mortgages = higher house prices. And off we go again into the cycle. Will this all come crashing down again? Probably, but it most likely will be from much higher prices than where we sit today.

And this is self-fulfilling. If you see house prices going up at 10% per year, and you can lock in borrow at 1% per year, then you’re more likely to go and bid up for that dream house or investment property. People do that maths and then act on it.

2) The impact on family finances

If we look at the financial household then lower interest rates are like a tax break – it goes straight to the bottom line. Combine this with higher savings from not being able to spend during the last 18 months, and you have some very healthy looking family balance sheets. This should be good news for the broader UK economy as people gradually get back to spending on the things they want to spend on: holidays, luxury goods, building projects (personal aside: have you tried to do some building work lately? Sheesh… it’s hard work! Massive labour and supply shortages everywhere).

3) For the retail banks, mortgages are the only games in town

Whilst nobody cries when banks struggle to make profits, these lower mortgage rates are a very interesting tell of their current predicament. Typically, banks and mortgage providers loan to the retail market and borrow in the wholesale market, and capture the spread in the middle.

For example, on five years fixed at 0.99%, Nationwide are funding this probably at something around the UK five year Govt Bond rate of 0.28%. That’s a nice spread of around 0.7% for minimal default risk. Happy days. They do the same with lending long-term and borrowing short-term to fund this, though Northern Rock found this strategy has its risks when the short-term credit markets seize up, like they did in 2007.

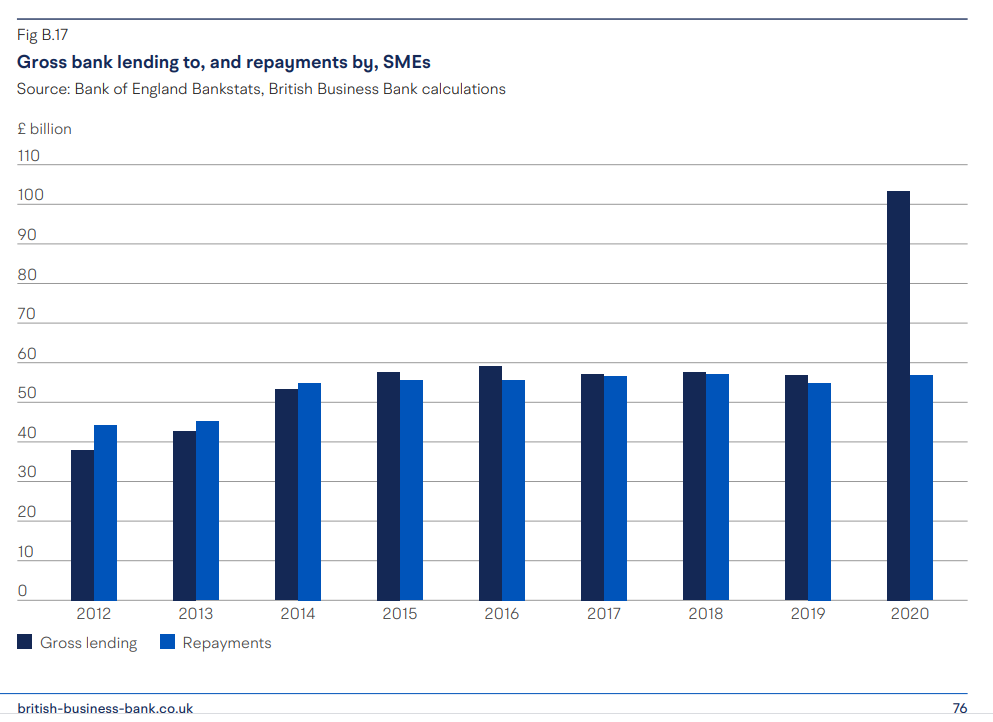

In retail mortgages this is working nicely right now. However, if you look at commercial and business loans, banks look to be struggling. Why? Because anybody who needed a loan over the last two years, presumably now has one which is UK government-guaranteed and interest-free for now. See chart below – this is a chart of gross bank lending to SMEs by British banks. You can see the enormous surge in loans in 2020, however with only an average amount of repayments.

The gap between the dark blue of loans and lighter blue of repayments in 2020 is striking. That has to be filled somewhere, which means either a) higher repayments in the years to come or b) significant reduced demand in new loans.

This means that banks have to compete where the market is hot right now… and that is in mortgages.

So to recap…

Is this good news? Good question. Like any good question, the correct answer is “it depends”. House prices should continue to rise, and mortgages should continue to get cheaper as banks get even more competitive. But it will finish at some point and the cycle will turn again.

Will it get sillier? Probably. When banks can lock-in 0.7% on five years, why not 0.5% or even lower? As described above, if banks are constrained in other areas, why not double-down on a profitable sector like mortgages.

Should I re-mortgage? Maybe. How does your current rate compare? Are there any penalties if you were to switch? The maths is fairly simple when we know these figures.

When will it end? Ha, even better question. There was a famous old City saying that when you were getting stock tips off the shoe-shine boy, then it was time to get out. I’m not sure what the current appropriate analogy would be but there will be one. Perhaps when UK property prices hit the front page of The Economist. That normally does the trick.

Whilst we don’t do mortgages ourselves, we work with a fantastic mortgage broker and will happily connect you. If you do have questions please get in touch.

All the best,

Adam