Annual Letter 2023

I sit down to write this letter on the first working day of 2024 and I am struck with gratitude. I have the opportunity to work with around 200 client families on their most important issues and I feel supremely honoured to do so. I also have gratitude for my team, without whom I could not help these 200 families as frankly, they do most of the work. Perhaps surprisingly, I also feel gratitude for where we are in the economic cycle. Interest rates should be falling over the next 12 months and growth should be rising – not straight away but certainly by the second half of the year. But more on this below.

2023 was a surprising year in a lot of ways economically and the way markets reacted. If you’ve known me for a while you know that one of my (many) regularly used phrases is The Economy is NOT the Stockmarket and The Stockmarket is NOT the Economy. Just because the economy may be tough for many people, doesn’t mean the markets will also follow that narrative. Markets tend to be driven by narratives more than anything and it’s our job as stewards of your funds to work out what that narrative will be. Let’s begin by looking at the economy.

The Economy

We began 2023 highlighting that everything was about inflation and it proved to be so.

UK inflation has been falling all year from its horrific unofficial peak of above 20% this time last year. I say unofficial because we follow Truflation rather than the official CPI print, as we feel Truflation gives a better overall measure of inflation.

US inflation bottomed out over the summer and then has been oscillating between 2% and 3% since. Frankly, a very acceptable level for the economy and central banks alike.

It became clear that by the end of Q1 that inflation globally was on a downward trajectory. This didn’t stop central banks continuing to raise interest rates in order to “control” prices – their words, not mine. When central banks say this, what they really mean is “we need to cause some economic pain in the economy so people don’t have as much discretionary spending power and companies can’t put their prices up as much because people will refuse to pay it.” You can see how controlling prices is a much more sensitive use of words.

However, there are two parts of inflation or prices that a central bank is looking to control. The first is the actual level of prices today, as measured by Truflation above. The second is the inflation expectations. That is, if people expect prices to rise in the future, then they naturally become more accepting to see them rise, rather than push-back or change their behaviour. I experienced this first-hand this year when our accountants informed me “because of CPI they were putting our prices up >10%”. We now have new accountants.

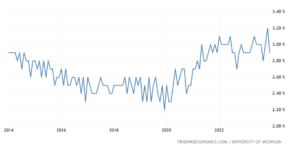

Longer-term inflation expectations have actually stayed relatively muted for the last 12 months which is a positive sign. See below for a measure in the US. This figure is measured through a random survey which simply asks the question “What rate do you expect inflation to be in 5 years time?”

The expectation of longer-term US inflation never really got above 3%. I would expect this figure to keep falling over the next few months as well. So that’s the good news.

The bad news is that, in the UK in particular, growth simply seems to be stuck.

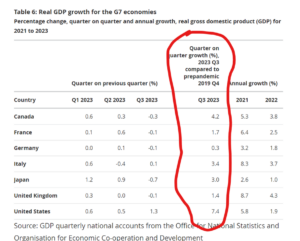

The chart below shows GDP changes over the past couple of years and I want to highlight the red-circled section which is the total increase in growth from Q4 2019 (i.e before lockdowns) to Q3 2023. Whilst Germany has the bleakest response across the G7 economies, the UK is next worst.

When an economy is being out-grown by Japan then you know something is not working. The state of the economy always has a large bearing on elections, so let’s see if it plays out this year at the ballot box. I think it will.

The key point though with lower growth is that, for the first time in 12 months and low inflation levels, the Bank of England has room to cut rates. My estimate is that this will start happening towards the end of March. The Bank of England’s crystal ball has obviously been very murky for the last couple of years and I do not expect that to change.

Markets

Global stock markets held up well in 2023 finishing with an astonishing rally into year end.

The US was the out-performer again for the year, supporting our overweight call in the PWP 100% equity portfolio, but for the UK to end up with +7.5% was a reasonable result. Emerging markets are still being held back by China which continues to suffer under Government actions. China’s day will come again at some point, but it certainly was not 2023.

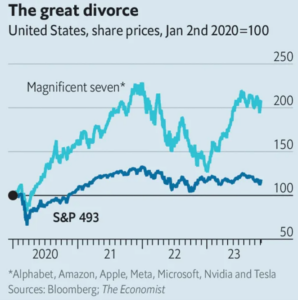

Back to the US again, and it probably won’t surprise you that the chief drivers of the market performance were the Magnificent 7 – Apple, Google, Amazon, Nvidia, Meta (Facebook), Microsoft and Tesla. I’m borrowing this chart below from The Economist.

This chart is even a little dated as the light blue line has now gone above the previous 2021 high. This outperformance is simply astonishing. How does this end? I have no idea, however when the largest, and most importantly fastest-growing companies in the world are putting up performances of +75% for the year, we simply need to be involved.

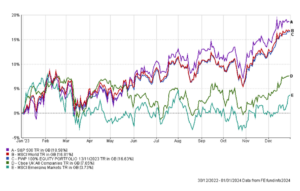

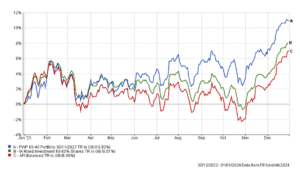

However, not everyone is invested in 100% equities, so if we look down the risk curve, we are very pleased with the results of our own PWP portfolios. An example below is our PWP 60-40 portfolio.

With an absolute return of above 10% and nearly 3% for the year above a “typical” Balanced fund, we have been really pleased (and we hope our clients have as well) with the performance of these portfolios. We can’t promise this outperformance every year, but our aim is clearly to continue to provide this value to our clients.

On the whole, your typical Balanced fund (and especially our PWP 60-40 portfolio) has reacted very positively to the lower inflation figures in the last few months of the year and to the prospect of interest rate cuts coming in 2024.

The Business

Permanent Wealth Partners had a great 2023 and we feel are really well set up for 2024. We had a successful year end drinks party, which was attended by around 50 clients, and it was great to catch up with all those who could make it. It was a really fun night, with our guests getting to meet the whole PWP team and we plan to do it again next year, so please come along if you can.

On a very selfish front, I was thrilled to announce the release of my book “Plan for Happy – a step-by-step guide to growing your money.”

This book has been a labour of love for the last couple of years and I am really pleased to finally get it into print.

In the book, I try to encapsulate our entire planning process as well as a lot of the theory behind what we do. Someone asked me if I was going to write another book and my response was “No way! Everything I know is already in this book!”.

As our valued clients, frankly you don’t need the book as you are already doing everything the book contains. However, for anyone else that you think could do with help, please pass the book onto them.

You can buy the book on Amazon here or by following the link below.

Or, frankly if you want a copy just let me know and I’ll send one out to you.

Our mission here is to help as many people as possible with their finances, as financial education can be seen as difficult or confusing. This we feel is a huge part of how we hope to add value to our clients. Sometimes people are afraid to ask, but as a service to all of our existing clients, if you can think of someone who would benefit from a conversation with me/us, please don’t be afraid to put them in touch. We would be delighted to chat to them.

In summary, whilst 2023 had its ups and downs, we are pleased to feel that we are heading in the right direction in 2024. I hope this letter finds you well and of course if you want to discuss your or someone else’s situation, please always feel free to get in touch.

I wish you a successful and prosperous 2024.

Adam Walkom