Bitcoin, crypto and the birth of a new generation of asset (Part 2 of 2)

Following on from Part 1, now that we have discussed the basics of Bitcoin and crypto, I wanted to see how it looks currently versus previous investment bubbles or fads.

Warning: As I said last week, these are my views only and not financial advice. Get in touch if you would like a further discussion.

Is it a bubble?

To start, let’s take a very brief view on what causes investment bubbles.

After my previous post, a client (thanks Robin) kindly reminded me of a great book “Extraordinary Popular Delusions and the Madness of Crowds” which I can highly recommend.

One of the many ideas the book brings is that investment bubbles don’t just begin out of nothing. They tend to start with some fundamental breakthrough in technology; some tectonic shift causes investors to believe that the world will never be the same again and they must get involved “at any price”.

It is that “madness of crowds” that inevitably causes the overexuberance of this shift and that is what makes the boom and bust cycle. However, the important point is that it starts with something real – a significant fundamental shift in technology.

If we look at some examples of past bubbles, I’ll highlight some of these major technological leaps that happened at the time.

Dutch Tulip Bubble

Invention of forwards, futures and options markets as well as exchanges to trade these on, founding of stock markets and other investment markets.

South Sea Bubble

One of the first joint stock companies which issued shares and paid dividends to its shareholders, founding capitalism as we know it.

1929 Stock Market Bubble

Invention of the modern manufacturing practices and the beginning of the industrial use of oil, founding the modern economy.

1999 Tech Bubble

The adoption of the internet in everyday economy, founding the online world as we know it.

2018-21 Crypto

Cryptocurrencies/ assets and digital technologies, founding of…?

If this is a bubble, then I would suggest it implies that something significant is happening in terms of the structure of financial markets.

Again, this is me just speculating, but how many of the fundamental shifts highlighted in the bubble above were predicted beforehand?

So just because we haven’t seen anything like this, doesn’t mean it cannot happen.

The adoption structure is different this time

To dig a little deeper on this, the actual structure of this bubble is a little different than other bubbles we’ve seen before. Historically when the investment ideas start to grow, the normal adoption or understanding cycle goes like this:

Insiders discover it, they create companies around it, then inside/ forward-thinking corporates push it, other corporates then adopt it and finally it hits the retail market/ investor.

If you think of most asset bubbles, they generally have this format.

Of course, this leaves the poor retail buyer as the last buyer before everything potentially goes pop.

However, with crypto and Bitcoin, it has been different.

It started with insiders in 2009/2010 and stayed there for a while, before jumping directly to retail investors from 2015 onwards. Corporates have really only begun to get involved in the last 12 months or so.

This is unusual in one sense that the order of adoption has been turned around. This could also go to explain the huge volatility and sell-offs we have seen on Bitcoin over its short life (more on this later) because the historically larger, slower corporate buyer has not been in the market until recently. One bullish argument is now they have arrived, the volatility should reduce.

And extending that perhaps, maybe we have still only hit the corporate part of the original lifecycle and we are yet to hit real mainstream retail adoption… If this is the case, then we probably can expect another big leg up in prices before everything goes pop again.

Soros’ theory of reflexivity

Another way to look at Bitcoin is to think in terms of investment theory. George Soros is a famous – perhaps infamous – investor who famously “broke the bank” back in 1992 and apparently made $1b by betting against the pound sterling.

Soros’ other fascinating work was effectively creating a new investment theory which was based on his experience and in contradiction to the classic efficient market hypothesis.

He called the theory ‘reflexivity’.

It implies that the current price of an asset is actually a factor that will influence the future price – both on the upside and the downside, ie a rising price will attract more buyers and that will self-reinforce until the buyers are exhausted, which causes a fall in the price which causes more investors to sell and so on.

If we consider Bitcoin through this lens, I think it has a lot of similarities.

A rising price has seen more people talk about it. More people talk about it means different products are created. More products give investors – both retail and institutional – greater options in buying them. This extra buying then increases the price and so on and it becomes a larger part of the overall financial system.

This doesn’t mean it cannot drop (and drop sharply) in the future, but with all the mechanisms in place in terms of products, investment vehicles and general adoption, it is harder and harder to see it disappearing altogether.

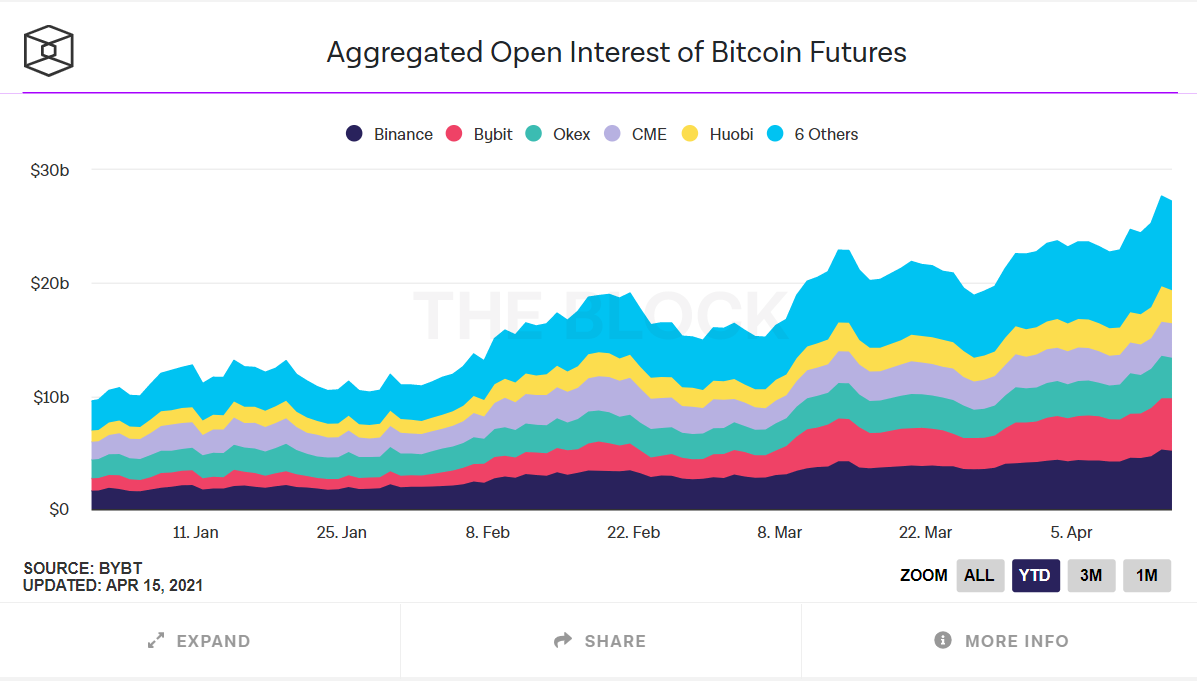

For an example of this, let us take a look at the open interest of Bitcoin futures.

The open interest of futures is the total size of positions outstanding. This chart is just from the beginning of 2021 and you can see over this short period, open interest has significantly increased from $10b at the start of the year to almost $30b now.

To put this in context, figures from the Chicago Mercantile Exchange – one of the biggest futures exchanges globally – has the following open interest on other assets:

Copper $25b

Gold $78b

Oil $150b

These figures are just from one exchange – albeit a big one – and not total figures like the Bitcoin chart above, but at least it gives a bit of context.

Summary: The interest in Bitcoin is rising very fast but is still a long way below oil and other major commodities.

But what about the volatility?

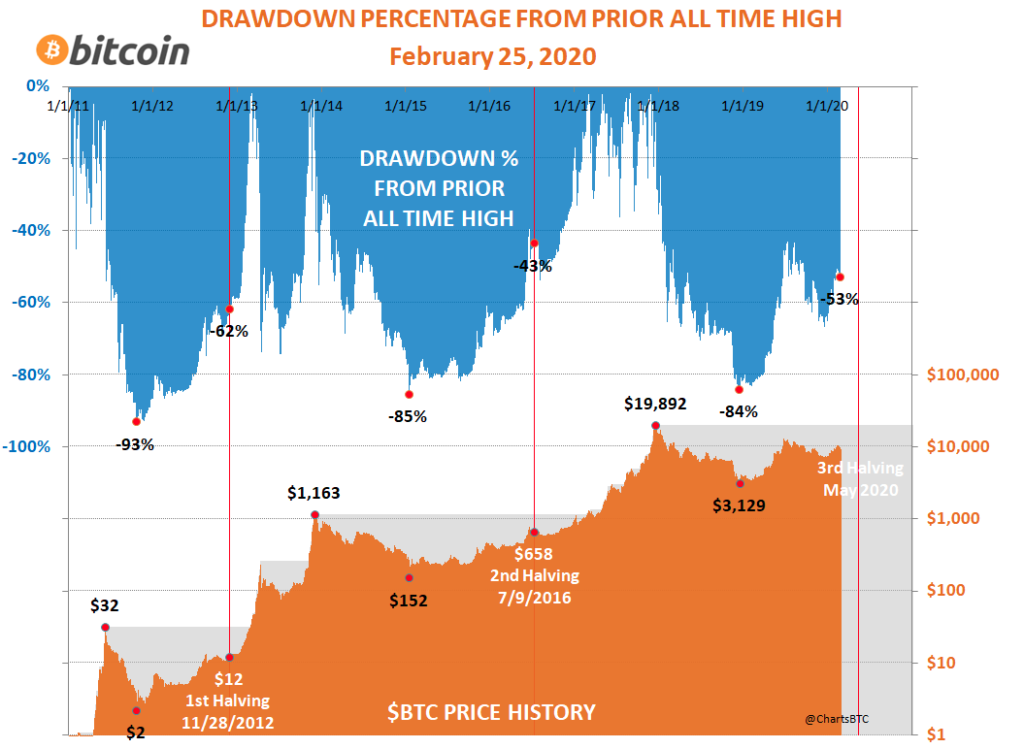

One of the biggest drawbacks of Bitcoin over the years has been the enormous volatility. There have been at least three separate times over its relatively short ten year history where the price has dropped over 80% from its peak. This fact alone makes it almost uninvestable for a number of investors who simply cannot handle that risk.

However shocking this may be, I find the most interesting thing about this is that, so far, every time it has been written off, it has bounced back and moved higher.

Each time the drawdown (or sell-off) has been that aggressive, many investors would simply think that the game was up and it would fade away. But it hasn’t.

And that is what I find very interesting.

Adam Robinson, a former chess prodigy and hedge fund consultant, says – I’ll paraphrase:

“When something doesn’t make sense to us in the investment markets, which is more likely? That our view of the world is all-knowing and perfect or that there is more going on in the asset that we are yet to understand.”

I think that perfectly summarises my position on this.

If Bitcoin was going to die, it would have died already. The longer Bitcoin and other crypto assets are around, and even more so, the higher the price and value, the more attention it gets and the more adopted it becomes into investment markets.

This is Soros’ reflexivity theory in action.

Look at all the recent announcements from the largest asset managers and payment providers in the world around Bitcoin and crypto – JP Morgan, Fidelity, State Street, Paypal, Square and even Tesla. All have made usage of Bitcoin and crypto more accepted and acceptable either as an investable asset or payment system.

When will we have potentially even 1% of global assets in crypto assets? I can see that day coming very soon, and then why stop at 1%? What’s wrong with 5%? 10%? Who knows…

And no prizes for guessing what that volume of buying does to the prices… (especially something like Bitcoin when it has a fixed supply of 21m).

So, to try and sum up…

Is this a bubble? Potentially.

Can it drop 80%-90% from here? Yes, very easily.

Do I think it’s here to stay? Absolutely.

In my view, we are too far down the road with this technology and there are too many involved interests now for crypto and digital assets not to become a core part of our financial system from now onwards.

What this means for the future of the individual assets is too early to tell. However, I think the crypto and blockchain fields will continue to have greater systematic importance to the financial system over the years to come.

Adam Walkom