‘Dog Fund’ Report

Last month, BestInvest published their bi-annual ‘Spot the Dog Report’, which sheds light on a list of equity funds which have been identified as serious and persistent underperformers compared to their benchmarks. We believe that this report provides some fascinating real-world data that flies in the face of expensive marketing spin and brochures produced by certain firms in our industry.

To be called a ‘dog fund’, a fund must deliver a worse return than the market it invests in over three consecutive 12-month periods and must also have underperformed that market by 5% or more over a full three-year period. This means that the portfolio of investors exposed to such ‘dog funds’ has considerably underperformed over the last 3 years.

In what may come as a surprise to some, St James’s Place (SJP), traditionally seen as a “safe” option to some investors due to their expensive marketing campaigns, featured six times in this list mainly due to the hidden costs and charges which make their funds extremely costly. Many large firms like SJP have expensive actively managed portfolios that they like to recommend to clients as clients pay fees to both their adviser and their SJP fund manager which is not always clear. As the fund management function is part of the same firm, costs are raised and are at risk of not providing the “value” that the FCA is looking for in recent Consumer Duty legislation. Smaller, independent financial adviser firms are typically more transparent about their fees and are also able to recommend very low-cost solutions for clients that can have a huge positive impact on client outcomes over the long term due to compounding.

The charts below compare the dog-funds by SJP to a low-cost equity portfolio offered by Permanent Wealth Partners (in blue), which will give you a hint of how the costs and charges can significantly hamper your portfolio returns.

Over the last three years, the PWP Equities portfolio has outperformed the best performing SJP dog fund by a staggering 20%, with this figure rising significantly to 53% when compared to their worst performing dog-funds.

So why should investors pay attention to the costs and how does a Financial Planner help?

We believe the charts above clearly showcase the value of independent financial advice which considers all aspects of investing and puts client at the centre of decision making.

To give an example of how this works in numbers, let’s say there are two investors A & B who invested £10,000 each. Investor A decides to seek advice from an Independent Financial Adviser and invests in a low-cost strategy such as the PWP 100% equities portfolio. Investor B goes with the perceived ‘safe’ and ‘reliably expensive’ company and invests into one of the dog funds – Global Emerging Market Fund after being convinced by the company salespeople on the merits and brilliance of the fund manager. At the end of the three years, the value of A’s investments would be £13,345 while that of investor B would be £7,970. The fund for investor B has to increase by 25% just for investor B to break even, while it needs to jump by nearly 100% to catch up with the fund value of investor A – and this is only after 3 years. With the passage of time and the effect of compounding boosting investor A’s portfolio, investor B would never be able to catch up.

Whilst we are never able to predict future performance, we can always control the fees. There is a huge amount of research available which highlights the significant impact that fees can have on a long-term performance. Keeping fees as low as possible is always a good idea.

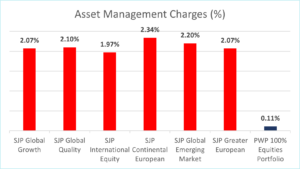

The chart below showcases the costs and charges associated with the SJP funds featured in the ‘Spot the Dog’ list, and provide a comparison with those associated with a fund provided by an Independent Financial Advisor (in this case, Permanent Wealth Partners):

As per the data, an investor investing in the cheapest dog fund by SJP would still be paying 1.86% extra on their investments in comparison to our low-cost equity portfolio and therefore even at outset, the least expensive SJP fund has to outperform the low-cost PWP 100% Equities portfolio by 1.86% annually. As mentioned earlier, the effect of high costs and charges significantly hinder the growth and compounding in the investors’ portfolio in the long run. High charges coupled with poor performance make it very difficult to achieve the best outcomes for the client.

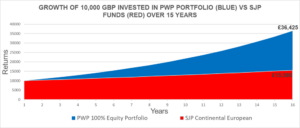

The table below highlights the future value differential between an inexpensive outperforming fund vs a costly underperforming dog fund, if the investors stay invested in the same strategy for the next 15 years. The assumed growth for the selected funds is based on the individual 5-year annualised growth for the funds.

In the above example, investing £10,000 in the wrong fund with its hidden costs and charges can have an impact of over £21,000 in future value over 15 years. Scarily, this is more than 2x the original investment. This alone highlights how crucial it is that investors are aware and fully informed of the costs and charges associated with their underlying assets to ensure their funds are on track to achieve the best possible outcomes.

The perception of ‘safety’ provided by larger, glossier, well-oiled marketing machines masquerading as financial advisers is exposed when proper analysis is conducted. This ‘safety’ ends up being very, very expensive and in our view, does not provide the best outcomes for the client.

If you are an investor through St James’s Place and would like a similar analysis done on your fund performance and true cost, please get in touch and we will happily do this for no charge.

Ammar Takhatwala