If you have a GIA, you may have to pay additional taxes this year – Here’s what you need to know

As the Labour government begins to establish itself in power for the first time in 14 years, this is a crucial time for people in the UK to get to grips with new tax laws and allowances. A significant part of this is understanding the changing GIA tax rules and how they might affect your investments. Whether you’re new to GIAs or experienced, it’s important to strategise and make informed decisions to benefit from these changes.

A higher tax bill above the expected is certainly surprising and not at all inviting, hence it’s important we tune into important changes affecting our tax bill this year and understanding the tax implications of GIAs is crucial for effective financial planning.

In this blog, we’ll guide you through the taxes you may need to consider and provide strategies to help minimise your tax liability.

What is a GIA?

A General Investment Account (GIA) is a flexible investment instrument that allows you to hold numerous types of assets from stocks to bonds. With this account, there is no cap on the amount you can invest, meaning you can invest as much as you want without restrictions which apply to structures such as ISAs (Individual Savings Account). This makes it a good option if you have already utilised your annual ISA allowance of £20,000. However, unlike a tax efficient wrapper such as an ISA, a GIA portfolio has no tax benefits. With a GIA, you may need to pay two types of taxes:

- Income Tax: You pay Income Tax on any money you earn from your GIA investments, like interest payments. The amount of tax depends on your total income and which tax bracket you fall under.

- Capital Gains Tax (CGT): If you sell an investment in your GIA for a profit, you may need to pay CGT. This tax is calculated based on the gain you make, not the total amount you receive. So, a simple calculation such as if you buy an investment for £100 and sell it for £200, you pay CGT on the £100 profit.

Now, what are the sudden tax implications you might face if you’re a GIA account holder?

The UK government has made several changes to tax laws pertaining to General Investment Accounts in recent years and here are the key ones to note:

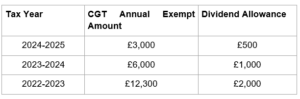

- Halving of CGT Allowance: This can be considered one of the most significant changes for the 23/24 and 24/25 tax year. The tax-free allowance on Capital Gains has been reduced to almost half in the current year with further reduction in the next tax year (shown in the table below). As GIA holders, any profits made above this will be subject to CGT. The same applies for dividends with a certain amount with £500 as the limit for tax free allowance in the 24/25 tax year. Dividends above this allowance are taxed according to the applicable dividend tax rates.

- Reporting Requirements: HMRC reporting requirements for capital gains and losses have tightened. To maintain compliance with HMRC requirements, GIA investors must diligently monitor and report any capital gains or losses, particularly considering the lower CGT limit.

Strategies to Mitigate Tax Liabilities

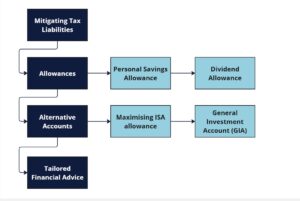

Investing in tax-efficient funds, making full use of allowances like the Personal Savings Allowance and Dividend Allowance, and considering alternative accounts like ISAs can help reduce your tax burden.

However, it’s important to remember that the tax you pay depends on your personal situation and tax rules can change over time. So it’s always a good idea to speak to a financial advisor or accountant to understand how much tax you may need to pay and explore ways to manage your tax bill efficiently.

Therefore, if you have a GIA or planning to open one, understanding and preparing for a tax bill is a must.

If you feel you could benefit by talking to a financial adviser for tailored advice and comprehensive financial planning, or you just want to have a chat about any of the points raised in this article, please get in touch by booking a 15 minute call free of charge with one of our professional advisers.