Managing your finances and long-term security as a Business Owner

When you’re building a business, you may put off managing your own finances as your focus is elsewhere. However, putting off your financial plan could mean you miss out on opportunities or overlook potential risks. Taking control of your finances now can mean you’re more secure in the future, which will boost your confidence.

Taking an income from your business: Salary and dividends

As you’re in control of your income, you could take steps to reduce your tax liability. Many business owners choose to take a salary and dividends to create an income. Read on to find out how your income could be taxed.

Calculating Income Tax when you take a salary from your business

If you want to take money from your business, one of the most common ways is by taking a salary. If you do, the income could be liable for Income Tax and it’s important to calculate how much the bill could be and the thresholds for paying a higher rate. Taking a salary would work in the same way as it does when you’re an employee. The salary will usually be classed as an expense in your business accounts.

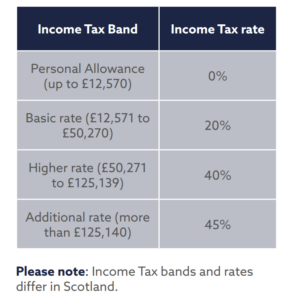

For the 2023/24 tax year, there is a key change to Income Tax bands, as the threshold at which taxpayers will pay the additional-rate of Income Tax has reduced from £150,000 to £125,140. For the 2023/24 tax year, Income Tax rates are:

When setting your salary, you should be mindful of the thresholds for paying the higher and additional rate of Income Tax to avoid an unexpected bill. While you can vary your salary if you choose to, paying yourself a consistent amount frequently can make it easier to manage both your household budget and business expenses. When setting a salary, it’s important to consider your personal financial needs and balance this with those of your business. Working with an accountant or financial planner can help you understand what’s right for you and plan for the long term.

Tax-efficiently boosting your income with dividends

Dividends offer you a tax-efficient way to boost your income. However, recent changes mean the Dividend Allowance isn’t as valuable as it once was. A dividend is a way of distributing some of a company’s profit. As a business owner, you may choose to pay yourself dividends.

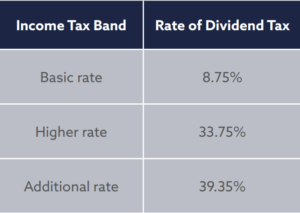

For the 2022/23 tax year, you could receive up to £2,000 before dividends were taxed. However, during the 2022 autumn statement, chancellor Jeremy Hunt announced the Dividend Allowance would be significantly reduced. For the 2023/24 tax year, the Dividend Allowance will fall to £1,000. It will then halve again to £500 for the 2024/25 tax year. The amount of tax you pay on dividends that exceed the allowance will depend on your Income Tax band. For the 2023/24 tax year, the rates are:

Using your Dividend Allowance can make financial sense. Paying yourself dividends to supplement your salary could also reduce your tax bill overall, even when you exceed the allowance. In addition, you don’t need to pay employer or employee National Insurance contributions (NICs) on dividends. So, it could reduce overall tax liability for both you and your business.

2 Practical Ways you can create financial security as a business owner

- Have an emergency fund you can use to pay for short term-outgoings

The unexpected can happen and it could harm your financial wellbeing. From an unexpected bill to needing to take time off work due to an illness, how would your finances cope if you faced a short-term shock? An emergency fund can provide you with cash savings to fall back on when you need it most. Yet, research from HSBC suggests that it’s something many people are overlooking.

The average amount held in an emergency fund was £7,606, but 1 in 5 people has £1,000 or less in their savings. How long would your savings last if your income stopped? How much you should have saved in your rainy day fund will depend on your needs. A general rule is to have between three and six months’ worth of expenses in an easily accessible cash account. This means you have enough to weather short-term shocks and it can provide peace of mind.

- Take out appropriate financial protection

While an emergency fund can ensure you can meet outgoings immediately, it often isn’t enough to provide medium- or long-term security. In some cases, financial protection could help you fill this gap. Financial protection would pay out when certain circumstances are met. There are several different options to choose from, so you can find one that provides the type of cover that suits your priorities and concerns. Among the most common types of financial protection you may want to consider are income protection and critical illness cover.

- Income protection: If your income stops due to an accident or illness, income protection would pay out a regular income. The income provided is usually a proportion of your normal salary, up to around 60%, and can enable you to meet essential costs without having to deplete your savings or other assets. Usually, an income protection policy will pay an income until you return to work, retire or the term ends.

- Critical illness cover: This would pay out a lump sum if you were diagnosed with a critical illness that is named within the policy. It could mean you’re able to take time off work, retire early, or make adaptions to your home if necessary. You can choose the level of cover to suit your needs. However, keep in mind that a critical illness cover will not cover every illness – you should carefully check how comprehensive the policy is.

If you have a family or dependents, you may also want to consider life insurance. This would pay out a lump sum to your loved ones if you passed away during the term. It could mean they can maintain their lifestyle and don’t need to worry about money should the worst happen.

Planning for the long-term

- The essentials you need to know about pensions

Are you saving into a pension and on track for retirement? Retirement could still be decades away, so it may seem like something you can put off thinking about. But delaying starting a pension or even pausing your contributions could have a much larger effect than you think. As well as your contributions, you’d also be missing out on potential tax relief and long-term investment growth. It means that when you start paying into a pension, your contributions may have to be much higher to achieve the same level of financial security in your later years.

A report in PensionsAge suggests that a 25-year[1]old earning an average salary and contributing the minimum auto-enrolment level of 5% could miss out on £4,600 at State Pension Age if they paused contributions for just a year. If your earnings are above average, the savings you miss out on could be even higher. So, while you may think saving for retirement isn’t a priority now, it often makes financial sense to regularly contribute to a pension.

What’s more, it can make sense from a business perspective. Making a pension contribution from pre-taxed company income is an allowable business expense. So, your business could receive tax relief, saving up to 25% in Corporation Tax.

- How much do you need to save for retirement

As a business owner, you’ll know how important a long-term plan is for success. And it’s no different when it comes to your pension. Understanding how much you’ll need to live the retirement lifestyle you want can help keep you on track throughout your working life. It means you could identify potential gaps much sooner and have options to bridge them. Calculating how much you need for retirement can be complex and involves bringing together lots of pieces of information. Here are some initial questions that can help:

- When do you want to retire?

- What income do you need?

As well as the answers to these two questions, you should also consider how inflation and changes to your income needs during retirement may affect your goal. In addition to your pension savings, you may also receive the State Pension, which can provide a reliable base income throughout retirement. You may also want to use other assets, such as investments or property, or your exit strategy could play a role in supplementing your income.

A tailored financial plan can help you pull together all these income streams and address any concerns you have, so you can have confidence when you retire.

2 Valuable Reasons why a pension is a tax-efficient way to save for retirement

- You’ll receive tax relief on your contributions

When you contribute to your pension, you’ll receive tax relief. This can provide a valuable boost to your retirement savings. Tax relief is given at the highest rate of Income Tax you pay. So, if you want to increase your pension by £100, you’d need to contribute:

- £80 if you’re a basic-rate taxpayer

- £60 if you’re a higher-rate taxpayer

- £55 if you’re an additional-rate taxpayer

In some cases, your pension provider will automatically claim tax relief at the basic rate on your behalf. If you’re a higher- or additional-rate taxpayer, you’ll need to complete a self-assessment tax return to receive all the tax relief you’re entitled to.

Previous research from PensionBee suggests that many pension savers are failing to claim all the tax relief they are entitled to. Between 2016/17 and 2018/19, 1.5 million high earners failed to claim an estimated £2.5 billion. The analysis found that over the three years, around 80% of higher-rate taxpayers and 52% of additional[1]rate taxpayers failed to complete a self[1]assessment tax return.

- You don’t pay Capital Gains Tax (CGT) on investments held to your pension

Usually, your pension contributions are invested. This provides an opportunity for your savings to grow over the long term. While investment returns cannot be guaranteed, historically, markets have delivered returns over longer time frames. This can help your pension to grow and keep pace with inflation. You should always consider your risk profile when investing, including through a pension. Investments held in a pension are not liable for CGT, so saving through a pension can help you get the most out of your money and reduce tax liability.

The amount of profit you can make when selling certain assets, including investments that aren’t held in an ISA, is falling, so it’s more important than ever that you understand how you could reduce your tax bill. The CGT Allowance fell from £12,300 to £6,000 in April 2023. It will fall again to £3,000 in April 2024.

Why Business Owners could benefit from working with a financial planner?

When you’re focusing on your business, it can be easy to neglect your personal finances. You may already have an accountant that helps you manage your business, but a financial planner can help you focus on yourself. Here are four reasons business owners should engage the services of a financial planner:

- They can help you set out your personal goals

- A financial plan can help you make the most out of your money

- They can help improve personal finance resilience

- A financial plan will cover your life when you leave the business

If you are a business owner and would like to have a chat about long-term financial planning and maximising the potential of your pension, please contact us or book a no-obligation 15 minute initial call with us, free of charge, to have a chat about your current financial situation and goals.

Adam Walkom