PWP ESG Portfolio Report

PWP are proud to launch a portfolio of ESG funds.

We’re delighted to announce due to the overwhelming success of the original PWP model portfolios, and some specific client requests, we have launched an ESG version of our PWP model portfolio series.

How we define ESG

When considering any ESG option, it is always important to define where exactly we land on a spectrum of responsible investment.

The graphic below, which was presented at a conference I recently attended, aims to give you an idea of how wide-ranging that spectrum can be.

Traditional investing with no regard for any ESG themes and a profit motive only sits on the left-hand side, whereas philanthropy with no regard for profit sits on the right.

Whilst discounting the far-left “Finance-only” section, because we cover that already through our range of traditional investment selection, we have a choice to make on which part of the “New Paradigm” we want to sit.

Given our over-riding goal is still to produce competitive returns, we have chosen to sit in the “Responsible” part of this spectrum with the new portfolios. We have placed our logo on the spectrum above to show this.

Why? Because our portfolios are index-based and use negative screening to exclude harmful or undesirable sectors and companies. This way, we are consistent with our over-arching investment strategy – also contained in our normal PWP portfolios – in that the portfolios adhere to the principal of low-cost index-tracking investment.

Examples of exclusions are tobacco, nuclear or controversial weapons, civilian firearms, adult entertainment, gambling etc.. Most areas that, in our belief, are not accretive to what we define as a civil society. One area I want to highlight that we have chosen NOT to exclude is fossil fuels. This may be controversial for some people but let me explain our thinking.

Let’s talk about fossil fuels

For this, we are guided by the research done by Shue and Hartzmak in their paper Counterproductive Sustainable Investing: The Impact Elasticity of Brown and Green Firms which intelligently doesn’t just classify green – or environmentally friendly firms – as good and brown – firms that have a significant carbon footprint – as bad. They view de-carbonisation as a process and critically depends on how different firms change their behaviour given different financial conditions. The conclusion in their words is “sustainable investing that directs capital away from brown firms and toward green firms may be counterproductive, in that it makes brown firms more brown without making green firms more green”. Starving the brown firms of capital i.e. not investing in them, makes no sense, because they are the firms where a change in behaviour can make a big difference. Think of it like this – if a company was to be able to reduce its total carbon output by 10%, which would have the bigger impact – BP or a windfarm? We firmly believe in this philosophy and if we are to transform our economy away from carbon and fossil fuels, then the leaders in this field will have to change the most.

Portfolio design

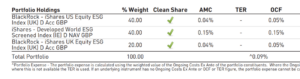

Similar to the original PWP portfolios, we have made up the 100% equity portfolio of 3 different index-tracking funds which are below.

You can see the low-cost properties of this portfolio demonstrated as well with the overall portfolio cost coming in at 0.09% per year.

Then, also like the original PWP portfolios, we blend this equity portfolio with our non-equity portfolio to produce a suitable risk-stratified portfolio where relevant. Typically this is 80-20 or 60-40. We will use the same non-equity portfolio we already have due to the issues in clarifying non-equity investments as ESG-friendly. How do you define a Government bond as ESG-friendly or not? How about Gold? These options are simply not available in easily accessible investments.

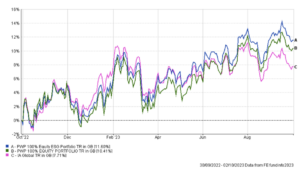

An interesting comparison is to compare the difference in performance between our ESG portfolios and non-ESG portfolios, also including a Global equity benchmark.

Both PWP portfolios continue to outperform the Global Equity benchmark IA Global which is good to see.

If you have any questions, or would like to discuss our PWP ESG portfolios, please get in touch.

Adam Walkom