Read our Venture Capital Trusts (VCTs) Report

Venture Capital Trusts (VCTs) are investment companies that are publicly listed recognised UK exchanges and set up to invest in smaller entrepreneurial UK businesses in order to help these companies grow.

To encourage support for these businesses, the government offers generous tax benefits for VCT investing which also reflect the higher-risk nature of VCT investing.

The Basics

How VCTs Work

How VCTs Work

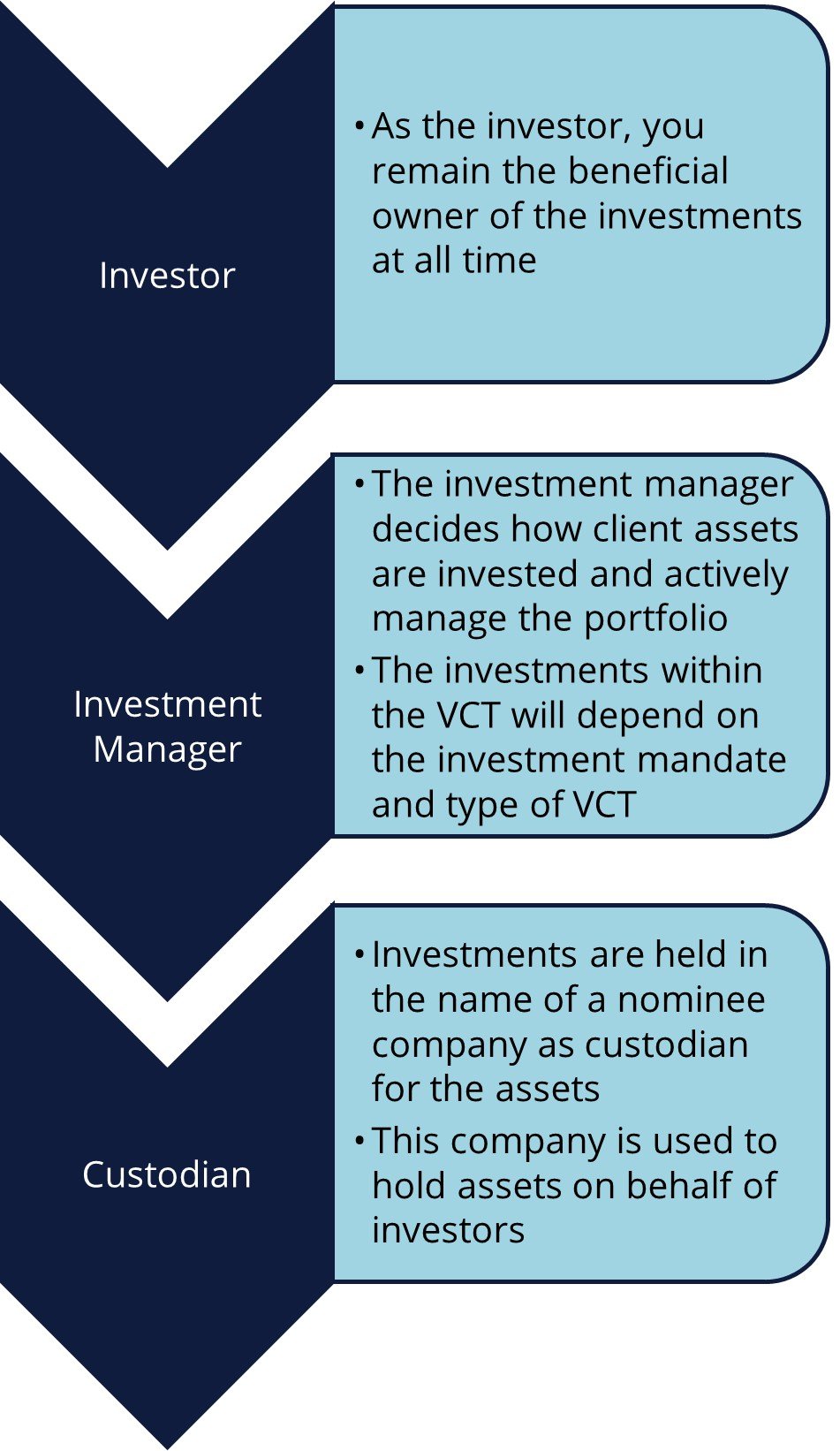

When you buy shares in a VCT, you are investing your money in a professionally managed portfolio of much smaller underlying businesses which you would often be otherwise unable to invest in.

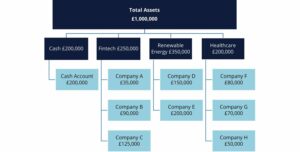

VCT funds are structured like other investment funds in that they are simply a pool of money set aside for a specific purpose. The VCT provider collects the pool from many participants (the investors) and collectively invests in businesses. The investment manager makes decisions on what businesses to invest in, how much to invest and when to move on from an investment. These investment decisions are based on the type of VCT and the investment mandate which outlines how investors’ assets are to be invested.

HMRC has strict criteria that a company must meet to qualify under the VCT investment scheme which cover the nature and size of the business as well as how long the business has been in existence for.

There are three different types of VCTs:

Generalist VCTs

The most common type of VCT with the broadest investment focus, as they invest in a wide range of small, usually unquoted companies in different sectors.

AIM VCTs

These VCTs invest in new shares in Alternative Market Index (AIM) listed companies. The underlying companies within the portfolio are not necessarily small or startup however must still meet the HMRC criteria.

Specialist VCTs

These VCTs focus on a specific sector, for example technology or sustainability. Specialist VCTs are generally seen as the highest risk as they do not offer sector diversification.

VCT Investment Structure Explained

Step 1: Funds are collected by the VCT manager from many investors

The total investment pool and number of investors will vary depending on the offering. A VCT provider may also apply an investment minimum.

Step 2: Pooled assets are deployed into a portfolio of different companies

The investment manager will then deploy funds depending what type of VCT it is and the investment mandate. Each VCT will have a different investment mandate and as such you should refer to the individual VCT’s product documents when considering where to invest your assets.

Tax Advantages

Given the higher risk nature of VCT investing, the government offers generous tax benefits.

30% initial income tax relief

For example: If you invested £200,000 in VCTs, you would receive an upfront tax relief of £60,000. You must hold the investment for at least five years otherwise the upfront tax relief must be repaid.

No tax on dividends

For example: If you invested £200,000 into VCTs with a 5% dividend return, you would receive £10,000 in tax free income. Alternatively, if you invested the same amount in shares on the London Stock Exchange, at a 5% dividend return, you would receive £6,000 after tax (assuming 40% tax rate).

After 20 years, a non VCT portfolio would be valued at £361,222, with a VCT portfolio worth £530,660 – an increase of £169,438.

Assumptions: 5% dividend return per annum with after tax dividends reinvested. No growth assumed.

Tax-free growth

For example: If you invested £200,000 with a 5% growth rate, after 20 years your investment would be worth £530,660 which represents a gain of £330,660.

Invested in VCTs, the capital gain would be 100% tax free when you realise the investment. Alternatively, if you invested the same amount in shares on the London Stock Exchange, you would pay capital gains tax at a rate of 20% or £66,132. If the funds were invested in property, capital gains tax would be payable at 28% or £92,585.

Assumptions: 5% growth per annum. Tax rates assume a higher or additional rate payer.

An individual may invest up to £200,000 per annum into VCTs and take advantage of the tax concessions. However you can only benefit from these concessions if you hold your VCT shares for at least five years. You may invest a higher amount, however concessional tax treatment is only available on the first £200,000.

The Market

Following the reduction in the annual pensions allowance for high earners, VCTs are in higher demand than ever before. Their increased usage in the years since the banking crisis of 2008/2009 has plugged a funding gap for early-stage businesses that banks previously dominated. Since April 2020, there has been further increase in demand for VCTs following the reduction in pension allowance for those earning in excess of £300,000.

There are a wide range of different VCT providers. These providers regularly raise money for a new fund by issuing new shares through an offer subscription. Shares in a VCT fund can also be bought on the secondary market. However these funds are generally illiquid and investors do not receive the upfront 30% initial tax relief when purchased on market.

Our Investment Philosophy

Our VCT investment philosophy is driven by each specific client’s needs and ensuring we provide the best outcomes for them, so we like to have a range of different VCTs on our panel that we feel comfortable to recommend.

Like the underlying companies that VCTs invest in, each VCT is unique and tends to have a particular style of investment.

Some focus on the very early-stage, seed growth phase and so have particular emphasis on growth. Others tend to focus on much larger, more established companies which pay regular dividends, and then you get a range of VCTs in-between. The factors we consider when reviewing VCTs are:

- Track record of good performance

- Established management team with good reputation

- Sensible cost and fee structure

- Style of investing – either growth-focused, income-focused or both.

We review our VCTs annually as each offering is time-limited and changes. This means just because a VCT has been on a panel regularly, it will not automatically go back on.

VCT Research

When recommending a VCT, it is important that we perform adequate research and due diligence. To assist us with this, we subscribe to and utilise the services of independent researchers Tax Efficient Review (TER). With a wealth of experience and sole focus on providing financial advisers with quality research, they offer an expert view into the VCT market and upcoming opportunities so that we can recommend a VCT that complements your existing investments and meets your investment objectives.

TER have provided independent reviews, comparisons and rankings of Venture Capital Trusts, Enterprise Investment Schemes and Business Relief offerings for over 20 years. The company publishes research on new tax efficient launches as well as briefing notes on key matters affecting fund managers or the tax-efficient industry as a whole.

The company is entirely independent as they are not paid to conduct their research by the fund managers they are reviewing, and staff hold no tax efficient investments personally, ensuring the research they publish remains objective.

The Major Providers

With the demand and growing size of the market, the list of major providers is ever increasing. Below is a list of the main businesses that are fundraising in the 2022/23 financial year.

The Provider Issue

The first challenge when researching the VCT market is that not all of the businesses that raised capital in the previous year will open for investment in the year that one is looking to invest.

The second challenge is subscription and early closure. It is highly likely that with increasing demand, VCTs will fulfil their fundraise capacity quickly and hence subscription in the VCT that one is looking to invest in may close earlier than the anticipated deadline.

Market Analysis

It is an almost impossible task to provide ‘panelled’ provider recommendations when so many of the preferred VCTs may be closed at the time you are looking to invest. It is also challenging with so many different types of VCT strategies:

- Early-stage vs mature

- Dividend paying vs growth orientated

- Generalist vs sector specific

As such, it is important that advice first starts with an objective-based discussion which covers the above points as well as your ongoing investment goals to determine what type of VCT best suits your needs.

Once we have had these discussions and arrived at some specific outcomes, we will review the VCT funds which are open for subscription to determine which one best meets your needs.

Get In Touch

If you are interested in or would like more information on investing in VCTs, we encourage you to get in contact with us to discuss your financial goals and how a VCT investment can work into your financial strategy.

Call us: +44 (0)20 3928 0950

Email us: hello@permanentwealth.co.uk

This explanatory note is prepared for clients of Permanent Wealth Partners LTD to assist in understanding a technical topic. This note is not advice, and no reliance should be placed on the content herein by any client or other party. This document is based upon our understanding of the UK tax laws at the time of writing. These matters are constantly subject to change and advice from a qualified financial adviser should be sought before making any decisions in relation to the topic of this note.

VCT | Venture Capital Trusts