Risk – the hidden danger of trying to be ‘safe’

I saw this photo and had to laugh.

It speaks to a thread of thought that has been bugging me ever since this pandemic started.

Which do you think is more dangerous to this boy in the yellow t-shirt?

1) Covid?

or

2) Riding a bike without a helmet on the street doing wheelies?

Yet he’s wearing a mask to protect himself from the ‘risk’ of Covid.

The complete mismanagement and misunderstanding of risk has taken on epic proportions since the start of the pandemic.

Primarily cheered on by the media and very strong government messaging aimed at ‘scaring the sh!t out of the public’ to specifically quote one anonymous MP, these messages have largely worked to keep people at home and obeying the rules.

The problem is this concept of doing everything we can to ‘stay safe’ from one specific (albeit dangerous) virus, has warped a lot of people’s understanding of what risk is and the potential trade-offs, and yes other risks, they face by trying to protect themselves.

I don’t mean to belittle the impact of the virus on individuals – where there have been truly tragic consequences – but I’m just trying to explore the consequences of the actions taken.

I refer back to the photo above. This boy is following the rules by wearing a mask. However what he is actually doing is protecting against one risk which is absolutely minuscule for him, compared to the other risks he faces whilst riding on the street without a helmet. That’s not a good trade-off in my view.

I don’t want this to be an anti-lockdown, anti-mask rant, because it’s not. I’m simply trying to highlight that If you try to solve one specific problem, there will always be unintended consequences, because life isn’t linear and doesn’t fit into statistical models. As the great Charlie Munger says: “To the man with only a hammer, every problem looks like a nail.”

I’ve referred to Nassim Nicholas Taleb previously in some of these notes as he has this wonderful theory/ book called Antifragile. (An aside: Interestingly, Taleb was extremely vocal that society and governments should have locked down earlier due to the severity of the virus on the individual level).

Anyway, one of his major ideas is that volatility, or unexpected situations, are going to happen, so instead of being surprised by this we should expect it and find ways for it to make us stronger – hence not being fragile but antifragile. He points out the severe downfalls of the management consultant-driven (I should know, as I was one once) focus on total optimisation of systems, which leaves no slack for any variability or volatility. Think train timetables. Commonly, when these optimised systems collide with reality, they fall to pieces because they have been totally over-engineered and any spare capacity that could act as a release valve has been taken out of the system. So the system breaks.

So what am I saying? Trying to suppress natural volatility and variability doesn’t work – in fact it normally fails with disastrous consequences. Volatility happens – that’s life. And life is risk. If you make decisions to protect yourself against one risk, those decisions expose you to other risks you haven’t even considered.

To take this down a notch and become a little more prosaic, let’s think about this from an investment viewpoint.

What is the ‘safest’ investment? Many people would say cash, because it will never drop, but is it safe?

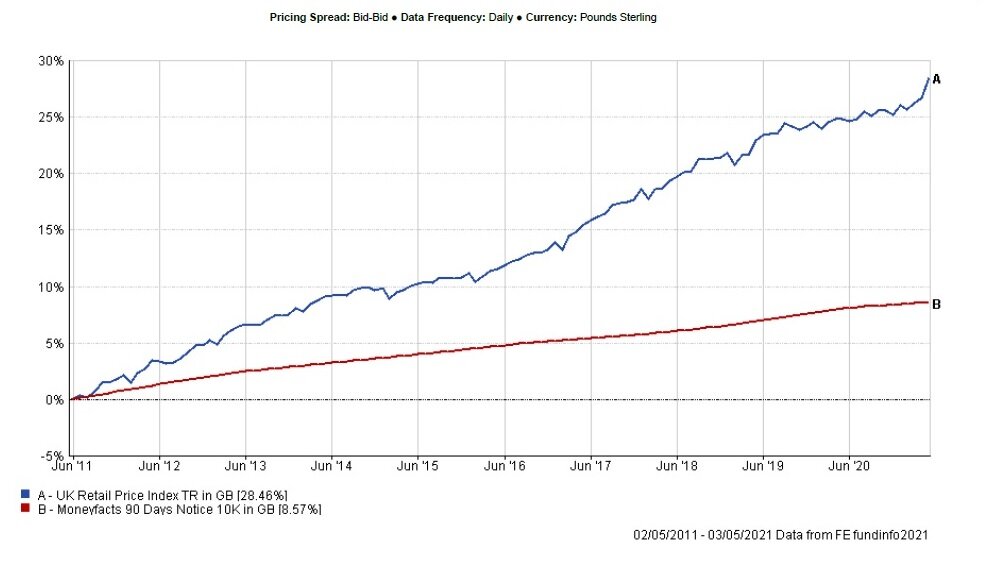

This is a 10-year chart of the return you would get from money in savings (red line) versus the UK Retail Price Index – the cost of stuff.

That cash doesn’t look very safe to me – over 10 years, it is worth nearly 20% less in purchasing power than it was in inflation-adjusted terms. Especially when I’ve written previously on that little spike at the top that we’ve just seen and with potentially more to come. If this is the performance in a low-inflation world, imagine what happens if we actually start to see real inflation?

So how do you protect against this? By embracing some of that volatility, some of that uncertainty and exposing your assets to growth. By understanding there will be ups and downs, and putting slack in your own financial system to let you cope with that. That is the only way you can make an above-inflation return in this world.

As most of you reading are already clients of mine, you have heard me talk about this since day one, but those that are not clients may be getting an idea on how I think about financial planning and managing wealth.

Maybe it’s because I’ve been cooped up too long in lockdown and I’m desperate to be free; maybe it’s because I’m sick of being told what I should be scared of and what I should be thankful for. Most likely it’s because I’m annoyed by the gross misrepresentation and manipulation of statistics to get a certain ‘message’ across and playing on people’s fears and misunderstanding of risk, without understanding and appreciating the consequences of doing so.

Anyway, I hope this finds you all well and you are all enjoying the rare event called sunshine that appears to be in the sky!

Adam