Welcome to 2023! It can’t get much worse than 2022!

For many of you who have previously dedicated your valuable attention to my musings throughout 2022, hopefully you have begun to recognise a theme. Whilst 2022 has been a year to forget for most investors – more of which I will discuss below – it has also been a fascinating and surprising year, where global political orders were challenged, many an investment theory turned on its head and England actually looked half-decent at football and cricket. See, I told you it was a surprising year.

From a geo-political standpoint, we cannot underestimate the impact of Russia invading Ukraine. The relatively comfortable “capitalism-at-all-costs” orthodoxy we have been living through since the fall of the Berlin Wall was shattered by Russian boots stepping onto Ukrainian soil. I would argue that not since the shooting of a certain Prussian Arch Duke has one specific moment started a wave of events that changed – and is still changing – global history.

Consider some of these economic impacts:

- Interest rates surging higher very quickly as Central Banks desperately try to control rampant inflation by attempting to push their own countries into recession

- Virtually every global government reassessing its energy policy in an attempt to become more self-reliant

- The largest global producers of goods re-assessing their supply chains to move away from concentrating risk in one particular country (no surprises for guessing. Starts with C… Five letters)

This is all going to change things going forward. The lowest-cost outsourcing model, one of the key deflationary factors over the previous 40 years, adopted by most global manufacturing firms and increasingly by individual governments for their energy policies, is over. Of course, low-cost will still be sought. However security and sustainability in the event of global conflict now has to become part of the conversation for the decision makers. A business can try to outsource manufacturing of its widgets to the cheapest producer to get the best margin, but they don’t even have a business if the supply of widgets gets shut off.

And what is the consistent factor across all these impacts? Everything is going to cost more…

Inflation is certainly coming off the top at the moment, more by demand destruction than anything else, but that will again change over time. A perhaps slightly lazy, yet useful economic trope is that an economy is said to be “in balance” when the interest rates are equivalent to the rate of growth. A high growth economy should have higher rates, a low growth economy, low rates.

An example of “out of balance” are the PIGS (Portugal, Ireland, Greece and Spain) during the first decade of the 2000s as they all happily adopted German interest rates. And we know how that ended.

If we do move to a more inflationary world, then how do our lower growth economies (yes, the UK) adapt to boost their growth rates? The fear of low-growth, high-inflation is the 1970s nightmare that keeps Central Bankers awake at night. However unpalatable it may seem, this is potentially the new world order we, and our esteemed leaders, will have to navigate through.

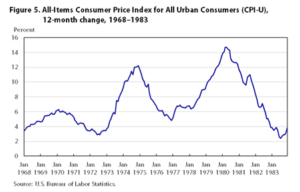

This is chart of interest rates in the 1970s that I sent out earlier this year

What is most noticeable about the above chart is the “double-rip” in inflation throughout the decade. Every period of time has its own unique circumstances, but to put it simply, it could happen again.

The other interesting chart I also posted previously from the 1970s was the corresponding stock market performance in the US.

The shock of the first inflation rip certainly battered markets. However the second inflation rip coincided with a jumping market driven mainly by “value” or lower-multiple stocks. Buying good-value, solid businesses and then just holding them for as long as possible. Sounds very Warren Buffet doesn’t it? See, I’m not always doom and gloom.

The charts that mattered for 2022

But before we prognosticate further on what 2023 may have in store, I would like to go back and review some of the quirkier charts of 2022…

Yes, that is a chart that compares UK Gilts (blue) to Bitcoin (red) for the last six months of 2022. My previous note on Liz Truss’ terrible timing and the impact on the UK Gilt market was well read, so you can go back to that for a description on why UK Gilts were so weak. However it was the volatility that was the most shocking element. The fact that I’m comparing UK government debt to Bitcoin is amazing in itself. However, it was the volatility that got very close to blowing up a few pension funds before the Bank of England saved the day – the only good thing they’ve done this year in my view.

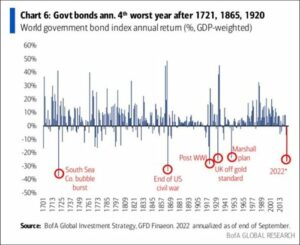

This was one of my favourite charts for 2022. This chart was from the end of September and bonds bounced a little from there. However it was still amazing to see that at this point a global index of government bonds had the fourth worst year since 1701!

The reason why this hurt investors so much in 2022 is because according to standard investment theory, this is not meant to happen. In your standard textbook theoretical investment model, the equities part of your portfolio is meant to give you the growth with volatility, but the bonds are meant to provide stability – well, not in 2022.

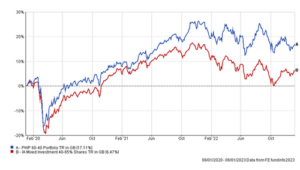

I don’t mean to belittle this point, however, as this year was most painful relatively for the investors who don’t want volatility. I’m talking about the Cautious investor. These investors want to take the least amount of risk, because they generally don’t like or cannot afford the volatility. The chart below tracks the performance of the most common risk categories – Cautious (green) , Balanced (red) and Aggressive (blue).

In a down market, we would expect to see Aggressive strategies under-performing Balanced and Cautious, and this indeed was the case in 2022. However, in relative terms, it is relatively common for an Aggressive strategy to be down around 13% for the year – yes, unpleasant but not particularly out of character. For the Cautious however, a drop of around 10% feels far more dramatic and is certainly rarer. However, there may be a silver lining to this for next year.

Looking forward to 2023

The good news I have is those investors who bore the brunt of 2022 – the Cautious and Balanced – are now in a position where if we do see a global recession, their bond holdings this year should provide some protection. Rates globally have risen to a level that now allows them to be cut again in the event of a recession – as long as inflation remains on its current downward path.

Building a successful portfolio does not mean trying to guess or pick the perfect outcome. It means providing a portfolio that performs as well as possible in as many different scenarios. Both the Cautious and Balanced portfolios now are in this position where they should provide far more protection for both an upside and downside surprise in global growth – put simply because the bond portion should start behaving more in line with how it has traditionally as interest rates are no longer at zero.

Inflation continues to show signs of falling across developed countries, which is a very positive sign. However it will be interesting to see how China’s full re-opening impacts this. Remember, the initial jump in inflation was as the world re-opened and demand took off. The risk to inflation is this repeats again as one of the world’s superpowers comes back online. Copper has just hit a six month high which gives us an early indication that industrial demand is returning. We will watch this carefully but also this can be a positive sign that global demand is returning.

In 2022, good news was bad news, meaning that every positive economic number was taken negatively by the markets as it implied interest rates would continue to rise. As inflation falls and we approach an interest rate level that global central banks seem content with, it remains to be seen whether this will continue to be the case in 2023.

The UK economy is showing some early signs of stabilisation, albeit at a relatively low level. Lower wholesale gas prices and the lowest input cost inflation in over a year is helping this, whilst demand and growth do seem to be holding up ok at this point. A little stability in politics should also help business confidence for 2023 and it always helps morale if we can keep united on a common enemy. In 2022 it was Vladimir Putin; for 2023 it looks like Harry and Meghan are making a very strong early claim for this title.

New model portfolios

We are proud to launch our new Permanent Wealth Partners model portfolios. Having worked and been investing in markets for over 25 years, we felt it’s time we started offering you some of that experience. Our model portfolios are based on a low-cost passive strategy, where we use asset and country exposure to achieve both diversification and growth.

The portfolios are suitable for our five different risk levels, where we blend our Equity and Non-Equity portfolios at 100%, 80%, 60% and 40%. The portfolios are reviewed monthly and then re-balanced quarterly to ensure alignment is consistent with the risk strategies.

One of our key goals for all clients is to lower the total cost of investment to as low as possible. These portfolios achieve this as the overall charge ranges from 0.11% to 0.15% across the risk range, with no extra management charge.

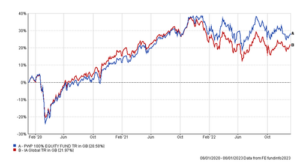

Here is the three-year performance of our 100% Equity portfolio:

And this is the three-year performance of our 60-40 Balanced portfolio:

Obviously past performance does not guarantee future success, but we’re very positive about our portfolios and will be discussing them with each of you throughout the year. If you have any questions, please feel free to get in touch.

With that I want to thank all our clients for their business in 2022. Looking after your finances is not a responsibility that we take lightly and we really appreciate your trust in us. I would also like to wish you all the best for a healthy and profitable 2023.

All the best,

Adam