What is the true rate of inflation?

When we think of ways to measure inflation, there is really only one measure that comes to mind – CPI or the Consumer Price Inflation. Every country has a measure for CPI and we are all guilty of comparing these figures with other countries, even though the base calculation of CPI is very different from country to country.

Nowhere does this become more apparent than when looking at inflation in the US and UK, two of the largest economies in the world.

From an initial glance, we can see US inflation is officially running at 4.9% versus UK inflation at 8.7%. So the UK is basically double.

But, this doesn’t tell the whole story.

The UK CPI doesn’t include home ownership. This needs us to use the newly established CPIH figure released by the ONS (currently 7.8%), so already we see a difference from the most well-known figure.

The other and more important issue with CPI everywhere is the way the data is collected. A report from Truflation highlights this issue:

“The CPI is usually calculated using data from door-to-door census or brick-and-mortar surveys at the point of purchase (PoP) and, most recently, phone surveys due to the pandemic. BLS workers painstakingly collect the data over the years and slowly input it into the legacy system. Many data sets are older than 2-years.”

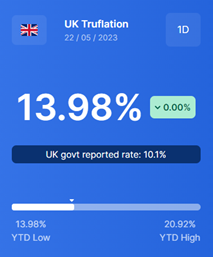

Truflation is an alternative data collector who utilises 10 million data points across double the number of categories in order to provide a far more ‘real’ version of what is actually happening to prices. This data is updated daily to try to provide a more accurate picture of how much prices are really going up.

And the results are staggering.

I’m lost for words here. The fact that the UK is SO much higher is simply frightening, but even more frightening was the peak above 20% which was around the end of December. The big factor again seems to be the UK’s utility bills and how we are charged for using energy.

The other factor is how much lower the US true inflation really seems to be. This is the good news: We live in a globalised world, so lower input prices, which is already clearly happening, should feed through to lower inflation. Here’s hoping.

We will be watching these figures going forwards and update you again soon.

If you have any questions about UK inflation and how it is affecting you, or would just like to chat about your financial situation, please get in touch.

You can contact us here or book a no-obligation 15-minute call here with one of our professional advisers.