What to do with cash?

We at Permanent Wealth Partners LTD are firm believers of equity investments. Our experience in Financial Markets and the historical data constantly suggests that investing in equities is the best way to maximize wealth and generate positive real returns net of inflation in the long run. Investing in equity has its own quirks and the most discussed phenomenon associated with equity investing is ‘Volatility’.

In simple terms, volatility is the swing in the value of the underlying assets on daily/ weekly/ monthly/ annual basis. The more volatile the investment, the more the investment value fluctuates in the short term. As you would have guessed by now, investing in equity comes hand in hand with embracing volatility. In the long run, the equity investments outperform the other conventional asset classes available, despite being highly volatile. As a result, Equity investing remains till today the core of any long-term financial investment plan, where the volatility and the equity exposure of the overall financial plan is adjusted by advisers to match the needs and tolerance on an individual level. Investments in financial markets always have a degree of associated volatility and investors are constantly made aware of the risk of capital loss associated.

However, such investments do not serve the purpose where capital protection becomes important. For short term needs such as paying for school fees, the downpayment for property purchase, or setting money aside for a leisure trip, it is necessary to ensure a certain amount of money is readily available to meet the funding requirements. Investing in markets for short-term needs further exposes investors to ‘sequencing risk’ which is a risk that you need to cash out investments at a time when the market for those assets is in a down time and you are unable to wait out the volatility, thus crystallizing losses leading to capital erosion without the ability or time to wait for the investments to recover.

So, what can you do to avoid capital erosion and still earn a good return with your money?

If you had asked this question 12 months ago, the answer would have been completely different as the rates available for holding cash were negligible. However, with the current inflationary environment and a continuous increase in the base rate by the Bank of England, it is now possible to earn a good return on cash and ensure your capital is safe in the short term to fund expected requirements. Here at Permanent Wealth Partners LTD, we have carefully analyzed various ways you can invest your cash in the short term and earn a decent return. We have outlined three of the best options below.

1) NS&I Bonds

When you invest your cash, you are effectively lending money to a borrower who pays you regular interest income to borrow the money along with capital repayment at the end of the borrow period. It can be a bank, a building society, or a corporate body. Nations Savings and Investments (“NS&I”) is where you lend money to the UK Government to help the government meet its funding requirements. Any investment in NS&I bonds is highly secure with negligible chance of default as it is backed by the UK government. Because the money is borrowed by the UK government, the cash invested is as close to risk free as we can get.

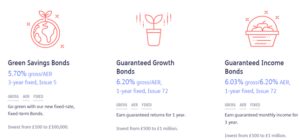

There are a variety of products you can consider investing in depending on the needs and requirements.

The alternatives above earn you a guaranteed return in exchange for locking the funds away from 1 – 3 years. If you have a lump sum fund and feel the requirements for the cash might be at least a year away, the NS&I bonds above can provide a healthy return. However, if you feel that your capital requirement might not be immediate but at the same time you do not want to lock funds away, you can use these NS&I products:

The products above do not lock in your funds, and you can withdraw the money any time you want without any penalties. However, these products pay lower returns in comparison to fixed dated bonds as you give up returns for liquidity.

Important – Any interest you receive on the NS&I investment bonds is taxable in the year the bond matures (for fixed dated bonds). You can also use your ‘Personal Savings Allowance’ against the interest received which is dependent on your tax rate. Please read the features of your chosen product carefully before taking a decision on the NS&I website.

2) Term Deposits

Another way of holding cash is to invest this in fixed term deposits. Term deposits have been historically available with banks and building societies. Furthermore, modern investment platforms also allow you to hold a term deposit within the platform to have all your investments consolidated under a single platform and visible for your ease of access. The recent increase in base rates has led to an increase in the rates available for term deposits. Like an NS&I bond, a term deposit would mean you lock away the funds for a particular period. An example of the current rates available on Transact.

The terms can range from as small as 6 months to as long as 3 years and can be invested through the platform. In case the company with which you hold the term deposit fails and is unable to return the money back to you, the term deposit would be covered by the Financial Services Compensation Scheme (FSCS) and would be covered up to a value of £85,000 per person per bank.

Please Note: With Term Deposits, you lock your money away for the entirety of the term and if you need early access to the funds, it may depend on the T&Cs of the underlying term deposit you choose to invest with. Please read the terms and conditions and key features documents carefully.

3) Platform Cash

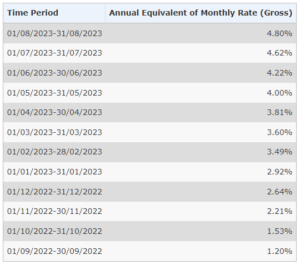

Lastly, you can just hold the cash you need in any of the existing wrappers on the investment platform along with your other investments. Although it sounds like the second option of investing in term deposit through a platform, you are not investing in a product but rather holding cash on a platform. The platform pays you interest for holding the cash within the platform. Holding the cash this way offers you liquidity to withdraw the cash whenever you want. However, the rates offered would be slightly reduced as compared to a term deposit in exchange for the said liquidity. Furthermore, the cash rates paid by the platform are not fixed and fluctuate depending on the prevailing market conditions. An example of current rates available on the Transact platform are as follows:

Please Note: The cash rates fluctuate monthly, and the final interest accrued would be dependent on the amount held each month and the rate payable in that month. Furthermore, the cash rates are not same for each platform and depend upon the individual platform policy with regards to client’s cash.

Disclaimer – The options mentioned in this article are for public knowledge and are not a recommendation. Any formal advice needs to take into consideration your individual circumstances as interest earned on cash investments is taxable. To know what the best option for you would be, book a call or email hello@permanentwealth.co.uk

Ammar Takhatwala