Why is UK inflation so much higher than anywhere else?

On Wednesday 19 April, the latest UK inflation figure was announced and came in at 10.1% – stubbornly remaining above 10% for the fifth month in a row.

Conversely, US inflation announced the week before was 5.0% for March. The chart below highlights several European countries’ overall inflation in the blue columns, in a range from 8.1% for Italy down to 3.1% for Spain. The orange column is without energy, which will give you a hint on what the rest of this note is about!

So why is the UK inflation figure so high and why is this a big deal?

The answer is both simple and complex at the same time. Let’s answer the latter first before coming back to the former.

It’s a very big deal because inflation is the single biggest driver of interest rate decisions by the Bank of England. This is important primarily because of mortgage rates – how much interest homeowners need to pay and also rates on corporate borrowing, as in how much interest companies need to pay.

You can see with both homeowners and companies, we have covered a very big slice of the overall UK economy.

What’s left? Government. And yes, they need to pay the higher rates as well on government bonds being issued. So virtually every sector of the entire economy is impacted by this – hence the big deal.

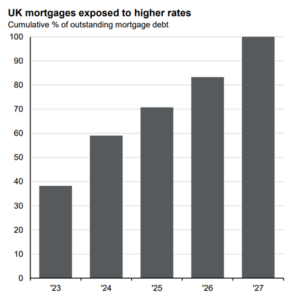

If we focus just on the public first, the last few years of low mortgage rates unsurprisingly caused a significant number of homeowners to lock in the low rates on offer for a fixed term of anywhere typically between two and five years. As the chart below shows (and any reader who has a fixed term mortgage is well aware of – including me) these mortgages are now rolling off these low rates onto far higher rates, causing these households to have less spending money. This cycle will be complete by 2027 and unless rates start falling, the UK householder will be considerably worse off.

Higher mortgage payment levels also limit borrowing for anyone looking to re-finance or purchase a house, so also keep a check on house prices. Some would argue this is a good thing – but considering residential housing is the biggest asset-class by far owned by UK citizens, then you can understand the benefits of prices going up to overall consumer behaviour.

Ok, I’m hearing now “Adam – very interesting, but get to the point. Why does the UK have higher inflation?”

At the moment just one simple reason – the UK energy pricing system or Energy Price Cap as it is called by Ofgem – the energy regulator. This is where the energy prices we pay are capped by Ofgem.

A bit of background on this. The concept of “fixing prices” is as old as basic economics and is far more of a political tool than anything else. And you can see the attraction. By “protecting” your voters or consumers, how can you be seen to be doing anything wrong? Unfortunately, history is a better teacher and shows the unintended consequences of fixing prices are so historically consistent that only anyone with no willingness to do the basic research on history, or a shameless vote-seeker, would attempt to do this now. Hang on, maybe one person would be that shameless…

Londoners are being priced out of their city. That simply isn’t right.

How much longer will the Govt ignore my calls to fix this?

Give me the power to freeze London rents.

— Mayor of London, Sadiq Khan (@MayorofLondon) April 19, 2023

Rents, historically, are the easiest examples to show the perils of trying to control prices. Rent controls were introduced in New York City in the 1960s and still exist today in some form there, and in Germany.

The simplest problem with fixing rents – it lowers the overall value (and generally quality) of the property because it discourages current and future investment in those properties. As a landlord, why would you invest in a property if you cannot charge more for it? Business Insider covered this in an article in September 2022.

With the passing of the New York’s Housing Stability and Tenant Protection Act of 2019, landlords are no longer able to legally increase rent upon vacancy in rent stabilized units; previously, landlords were legally allowed to raise rents up to 20% between tenants to recoup construction cost. Many landlords do not fill their vacant rent stabilized units, as the operational and renovation costs may exceed the legal maximum rent. As of 2022, there are roughly 20,000 vacant rent stabilized apartments in New York City.

Unintended consequences strike again.

But I digress – we’re not discussing rents here – we are talking about electricity prices. However, the concept is the same.

For the UK power system, the under-investment is not necessarily the problem, as the infrastructure is owned by National Grid. The issue is more basic.

The energy companies effectively re-selling the energy to the retail customer are subject to variable wholesale prices, but are capped on prices they can sell on. That sounds like a terrible business model, why would anyone do it?

The reason is: Ofgem understands this, so it sets the upcoming energy cap at what it typically has cost the energy companies to pre-buy this energy plus a small profit margin. The energy companies typically buy power on the forward market 6-9 months in advance because they need to have certainty of their input costs if their selling price is fixed.

The Institute for Government explains this in more detail:

For example, the cap for October – December 2022 was announced in August and determined using the prices observed on the forward market between May and August.

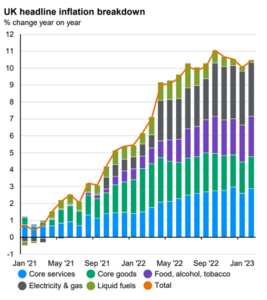

Put simply, the energy prices we’re paying today were actually wholesale prices set around 6-8 months ago. The upshot being we are still paying much higher prices even though wholesale prices today are much lower. See the chart below on UK headline inflation and look at the grey section for the pure energy contribution to inflation, along with the non-direct contribution into food prices and other goods. As I described in the opening paragraph, this legacy inflation has real, live-time impact in terms of the cost of borrowing today.

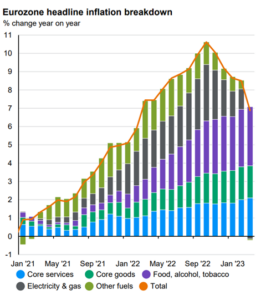

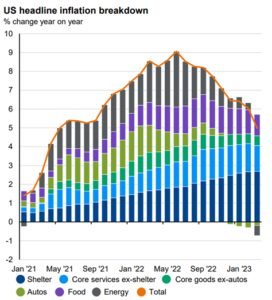

And just to make you wince or cry (maybe that’s just me), look at the charts below – especially focus on the grey section which is energy – for the impact of energy prices on inflation for both the US and Europe. Yes, that is correct – both were negative last month!

I don’t know what pricing structure they use in the US and Europe on retail energy markets, but it has got to be better than what we have currently here in the UK.

And the most surprising thing for me – nobody mentions this!

Not only are we paying more in energy costs than basically any other country, we are dealing with the resultant higher inflation and the other follow-on higher interest costs associated with it.

The good news is that the next energy cap review will be done in July which SHOULD see prices fall, but you know me well enough by now… the cynic in me is waiting for the headlines to say this won’t be happening.

If you have any questions about the topics discussed in this article, please get in touch. You can book a FREE 15-minute initial call with one of our qualified advisers.